In Nigeria’s downstream petroleum sector, business competition rarely follows textbook rules. It is an industry shaped by entrenched interests, political interests, power capture, regulatory capture, and institutional import cartels. Into this tightly controlled space stepped Alhaji Aliko Dangote armed not with subsidies or political patronage, but with a $20 billion refinery.

Alhaji Aliko Dangote leaves no stone unturned, with full force, he has taken on the age-old cabal in Nigeria’s downstream petroleum sector, an industry as deeply entrenched as it is politically shielded. The alleged point man of this cabal, Farouk Ahmed, who until recently served as the regulatory head supervising the downstream sector, has found himself at the center of the storm. Dangote’s approach to this confrontation is nothing short of applying guerrilla warfare in business.

According to Oatts (1949), a guerrilla is defined as an irregular combatant fighting in their own country or at least in a country in which they reside, whose main strength lies in their intimate knowledge of the terrain in which they operate. Britannica further defines guerrilla warfare as a form of warfare fought by irregular forces using fast moving, small-scale actions against orthodox military or police forces, and sometimes against rival insurgent forces, either independently or as part of a broader political-military strategy.

By analogy, Dangote’s recent unorthodox moves in Nigeria’s downstream petroleum market mirror these guerrilla tactics. His strategy departs sharply from conventional corporate competition and instead reflects a calculated, asymmetric confrontation with entrenched interests.

In examining Aliko Dangote’s attempt to achieve market dominance in the downstream sector, guerrilla warfare manifests through the following characteristics:

- A defined “country”

- Intimate knowledge

- Irregular Combatant

- Fast-moving tactics

- Rivalry and competition

A COUNTRY (THE BATTLEFIELD)

In any warfare, there must be a defined territory worth fighting for. A country can be likened to a market or product. In this case, the “country” is the importation and pricing of Premium Motor Spirit (PMS) in Nigeria.

Alhaji Dangote committed an estimated USD 20 billion to the construction of the Dangote Refinery, adjudged the largest single-train refinery in the world, with a processing capacity of 650,000 barrels per day. Such an investment is not merely commercial; it is existential. Consequently, Dangote is prepared to deploy every available tool: economic, political, media, and sentiment to protect and dominate this market space.

INTIMATE KNOWLEDGE

Before committing such an enormous sum, Dangote undoubtedly relied on extensive feasibility and viability analyses conducted by top-tier professionals and consulting firms. However, while these analyses provide paper-based and theoretical understanding, intimate knowledge of an industry often resides with long-standing insiders.

The downstream petroleum sector is one such industry. Regardless of the caliber of consultants engaged, certain hidden intricacies, informal arrangements, regulatory loopholes, and power dynamics remain known only to dominant legacy players. Dangote entered the sector with capital strength and strategic intent, but without the historical embeddedness enjoyed by entrenched importers and regulators. His subsequent actions suggest a rapid learning curve, acquired not through textbooks but through confrontation.

IRREGULAR COMBATANT

Dangote has operated successfully for over two decades across sectors such as cement, sugar, rice, tomato processing, and beverages, industries largely within the fast moving consumer goods (FMCG) space. The oil and gas sector represents a significant departure from his traditional business terrain.

In this conflict, Dangote is the irregular combatant, while the dominant PMS importers are the orthodox forces. Since the official commencement of refinery operations, Dangote has embarked on an aggressive media campaign, granting over twenty public interviews to promote local refining and expose structural inefficiencies in fuel importation.

Beyond media advocacy, pricing has become a weapon. Dangote repeatedly reduced PMS prices in an attempt to undercut importers and force them out of the market. When media engagement and pricing strategies proved insufficient on their own, a more decisive tactic emerged: the public exposure of the regulatory leadership of the sector. The recent spotlight on Farouk Ahmed represents the final escalation in this asymmetric campaign.

FAST-MOVING TACTICS

Guerrilla warfare thrives on speed, surprise, and unconventional maneuvering. Dangote’s actions reflect these principles. With massive capital already sunk into the refinery, he has moved with unprecedented urgency to secure market dominance and, ultimately, monopoly power.

Meanwhile, his rivals appear to be playing a waiting game, silently countering his moves through established networks while avoiding public confrontation. Dangote, on the other hand, has embraced public opinion, national sentiment, and media visibility as strategic assets, framing his struggle as one between national interest and entrenched profiteering.

RIVALRY AND COMPETITION

Healthy competition is essential for unlocking the full potential of any industry. It allows multiple players to innovate, compete, and serve consumers efficiently. According to Porter’s Five Forces, industry competition is shaped by:

- Rivalry among existing competitors

- Threat of new entrants

- Bargaining power of suppliers

- Bargaining power of customers

- Threat of substitute products

Dangote’s entry into the downstream sector has activated all five forces simultaneously. However, his strategy departs from conventional competition. Rather than relying solely on scale and efficiency, he has introduced an unconventional dominance strategy, one that targets not just competitors but also the regulatory architecture protecting them.

By effectively “holding the jugular” of the regulatory leadership, Dangote has shifted the battleground from market pricing to institutional legitimacy. This marks the clearest expression of guerrilla warfare in business: asymmetric power deployed against entrenched authority to redefine the rules of engagement.

CONCLUSION

Dangote’s confrontation with the downstream petroleum cabal is not merely a business dispute; it is a strategic war fought with unconventional tools. His approach exemplifies how capital, media influence, pricing power, and regulatory exposure can be combined into a guerrilla strategy aimed at dismantling entrenched market structures. Whether this leads to true competition or a new monopoly remains the ultimate question.

This is a master class and well researched article from a well-informed cerebral mind with academic orientation.

I give kudos to the author.

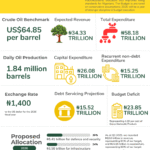

Pingback: Nigeria’s 2026 Budget Breakdown: Expenditure, Revenue, and Sectoral Allocations - the financial thrive