Last Updated on 29/06/2025 by Rasheed Busari

Business plan is a necessary tool and document In an economy where small businesses represent 96% of all enterprises and employ over 80% of the workforce, Nigerian entrepreneurs continue to face a thought-provoking stigma: great business ideas, limited or no access to capital. From Lagos to Aba, Aba to Kano, and all nooks and crannies of the country, entrepreneurs echo the same rhetoric: “The banks say come back with a better plan, your business is not ripe for credit, and investors barely read past the executive summary”.

So, what makes a business plan fundable in the Nigerian market?

Whether you’re applying for a ₦10 million business loan from the Bank of Industry (BOI), seeking equity funding from a local angel syndicate, seeking capital raise from venture capital, or approaching a commercial bank with strict lending covenants, one thing remains constant: a well structured and organized business sells and promotes confidence in doing business with.

The Nigerian Reality: Why Most Business Plans Fail to Attract Capital

Banks in Nigeria are conservative for good reason, particularly for MSMEs, due to issues such as lack of business structure, bookkeeping problems, data and identity issues, falsification of records and data, and inadequate business leadership skills. Non-performing loan (NPL) ratios have historically hovered above regulatory thresholds due to these issues. Recently, the Central Bank of Nigeria mandated all banks under CBN forbearance to fully disclose their NPL and stop dividend payments to shareholders. Investors, both local and international, are equally cautious of the Nigerian market, wary of currency volatility, policy instability, corporate governance issues, and a generally opaque business environment.

Thus, a fundable business plan must address four key questions:

- Can this business generate cash flows in this volatile economy?

- Is the promoter capable, transparent, and accountable to run the business with right leadership and management skills?

- Does the plan demonstrate a real understanding of local market and international market dynamics and its impact on the business?

- Does the business align with the current Government policy directions and interests?

If the questions above can be genuinely answered, you are closer to getting access to funds and credit from any banks, investors, equity partners, etc.

The Anatomy of a Fundable Business Plan

A business plan is like a manual that depicts what the business is all about and how the business will be run now and in the foreseeable future. Let’s break this down with emphasis on what Nigerian banks and investors are looking for.

1. Executive Summary: This Is Your Elevator Pitch

The executive summarizes what the business is all about in a simple and understandable language. It should be short, concise, and simple, and if possible, present as an infographic, as investors do not have the luxury of time. Go straight to the main points and avoid unnecessary details:

- What your business does

- How much funding you’re seeking

- What you’ll do with it

- Expected ROI or repayment timeline

- Value proposition

- Problem you are solving

- Unique selling points

2. Business Description: Your Identity, Your Purpose

Provide a crisp background about the business, with a focus on the brand, value, and purpose:

- Legal structure (e.g., CAC registration and registration with regulatory authorities if need be)

- Mission and Vision Statement, Core Values

- History of operations

- Key milestones

- Jurisdiction of business and operations

- Products/services and unique value proposition (UVP)

Due to the volatile nature of the Nigerian market, Investors want to know if your business can scale and survive despite infrastructure challenges or policy headwinds and without depending on Government assistance.

3. Market Analysis: Data-Driven, Locally Grounded

Have a thorough knowledge and understanding of your local market, industry, sectors, market associations, prime movers in your niche, and competition. Also, keep abreast of international and global market events that could likely impact negatively or positively on your business.

- Target customers and demographics

- Market size and growth potential

- Competitive landscape and your differentiator

- Demographic details of your target market and target customers

- The percentage of total market size/share you intend to capture

- Your competition at the market, sector, and industry level

4. Organizational and Management Structure

Banks and investors want confidence in leadership and management. A good business idea with the best business plan without quality leadership is already a sinking business. Profile key team members with:

- Track record

- Relevant experience

- Defined roles and responsibilities

If you lack formal staff, leadership, and management, outline your plan for outsourcing or scaling HR efficiently in your business plan when pitching to investors.

5. Product or Service Line

Describe:

- How the product is made or delivered

- Pricing strategy

- How to source raw materials

- Local sourcing advantages or backward integration plans or international sourcing plans

- Intellectual property, licensing, or trade marks (if applicable)

Highlight how your products or services withstand economy and market shocks synonymous with the Nigerian market, like fuel scarcity, transportation cost, multiple taxation, insecurity, kidnapping, Fulani herdsmen issue, import bans, or FX restrictions.

6. Marketing and Sales Strategy

Marketing and sales work towards the same goal for the business, which is revenue generation, but have different approaches, meanings, and strategies. Marketing entails efforts in creating product awareness and interest in a product or service, while sales entail the conversion of interest into the actual purchase of the product or service. Outline:

- Distribution channels (digital, retail, B2B, B2C, B2G, etc.)

- Customer acquisition cost (CAC)

- Customer Retention Strategy

- Percentage of market to acquire

- Advertising cost and channels

- Pricing and Subscription Model

- Market expansion plans

- Partnership Plans

- Sales team incentives (if any)

7. Funding Request and Use of Funds

This section shows how funds would be raised in relation to the need and usage of the funds. It shows how funds would be raised and allocated amongst departments to achieve the business’s overall goal of revenue generation and profit-making. Be specific:

- Total amount needed

- Sources of funds

- Allocation: inventory, staffing, equipment, marketing, advertising, outsourcing, etc.

- Repayment plan (if debt)

- ROI expectation (if equity)

Do not round figures; be specific with your numbers. A ₦10.7m request reads more credible than “about ₦11 million.

8. Financial Projections: The Deal Maker

Investors are after the safety of their funds, and it is Financial projections that would likely depict if the business is viable or not for investment and funding. Make sure your projections align and link back to your business model to ensure the business is real, viable, and sustainable. Base your projection on your historical or current activities, industry activities, or market activities. The projection should be in three folds: worst case scenario, best case scenario, and neutral case scenario, to keep the investors abreast of the likely situations of the business in case of any of the scenarios. Implement an exit trigger to signal the exit of investors in case the business doesn’t go as planned, to protect investors’ principal. This section can be presented in a spreadsheet or infographic format. Provide:

- 3–5 year projections

- Profit & Loss Statement

- Cash Flow Statement

- Balance Sheet

- Break-even analysis

- working capital analysis

- Exit strategy or exit signal in case the business does not go as planned

- Loan amortization schedule (for bank loans)

If your raised fund or capital is in dollars, please factor in Foreign exchange fluctuations in your projection. Use realistic assumptions in your projection:

- FX rates

- Interest rates

- Energy costs

- Inflation (currently over 30% YoY in Nigeria)

9. Risk Assessment and Mitigation

Banks and investors want their money back and the safety of their funds with a guarantee for principal and interest repayment for banks, while for investors, principal and returns repayment. Investors want returns and, worst-case scenario, the safety of principal. Address the following likely risks affecting Nigeria market:

- FX risk

- Political instability

- Product distribution risk (accident, bad roads, etc)

- Regulatory changes

- Market entry challenges

Highlight the possible risks and mitigants put in place to address and manage the risks. Show that you are proactively aware of the uncertainty in your market and have plans in place in managing uncertainty, and not reacting to it.

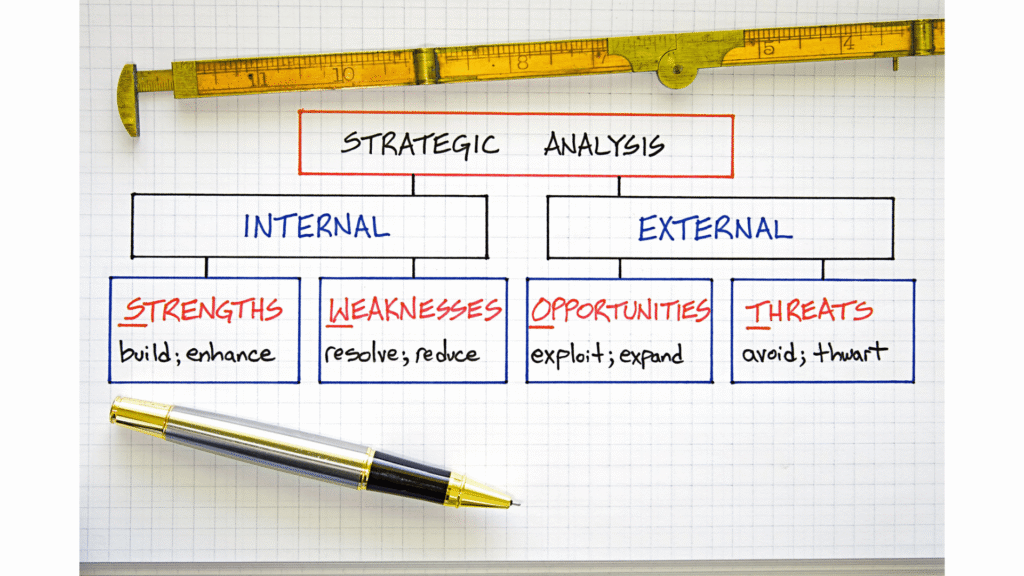

10. SWOT Analysis

Swot analysis is very critical to the successful execution of the business plan as it highlights the business environment: internal environment (Strengths and Weaknesses) and external environment (Opportunities and Threats). It depicts how the internal environment impacts the external environment and vice versa. A well written business plan must identify and highlights strengths, weaknesses, opportunites and threats on the business.

- Strengths: What are the strengths in the business? Like, access to cheap raw materials, staff strength, proximity, capital, etc. These are the factors that give the business leverage to scale and ensure efficiency.

- Weaknesses: these are the factors that the business does not have strength or can leverage on. The presence of these can affect the business’s not to scale and operate efficiently

- Opportunities: these are the factors outside the company’s reach that, if considered, can lead to expansion of the business, better acceptance of the business product and improved business revenue and profit.

- Threats: These are external factors inimical to the existence and sustainability of the business.

11. Appendices

Include all documentation and relevant things that will aid in decision making as regards to investment and fundraising to show the business is real and viable:

- CAC Certificate

- TIN (Tax Identification Number)

- Regulatory licenses and certifications (if applicable)

- Past financials statement records

- MOUs, LOIs, supplier agreements

- Any other documents relevant to the business plan and fundraising.

Make it Local, Make it Real

In developed markets, investors fund ideas, while in frontier markets like Nigeria, they fund execution. Your business plan and ideas must be real and easy to execute with a guarantee of steady cash flow. Banks will reject even a profitable idea if your plan lacks structure or transparency. Investors will pass on high-ROI ventures if the promoter appears unreliable or poorly informed. A fundable business plan is not an academic report. It is a persuasive business case that says:

“This is how I will grow your money. And this is how I will protect it.”

About the Author

The Financial Thrive Team is committed to providing data-driven, thought-provoking insights on economics, personal finance, governance, and financial literacy, especially within Nigeria and other frontier markets.

Your writing has a gentle luminosity. Each idea shines without overwhelming, illuminating pathways for thought and reflection.

Hi, Neat post. There is a problem with your website in internet explorer, would test this… IE still is the market leader and a big portion of people will miss your great writing due to this problem.