Last Updated on 26/12/2025 by Rasheed Busari

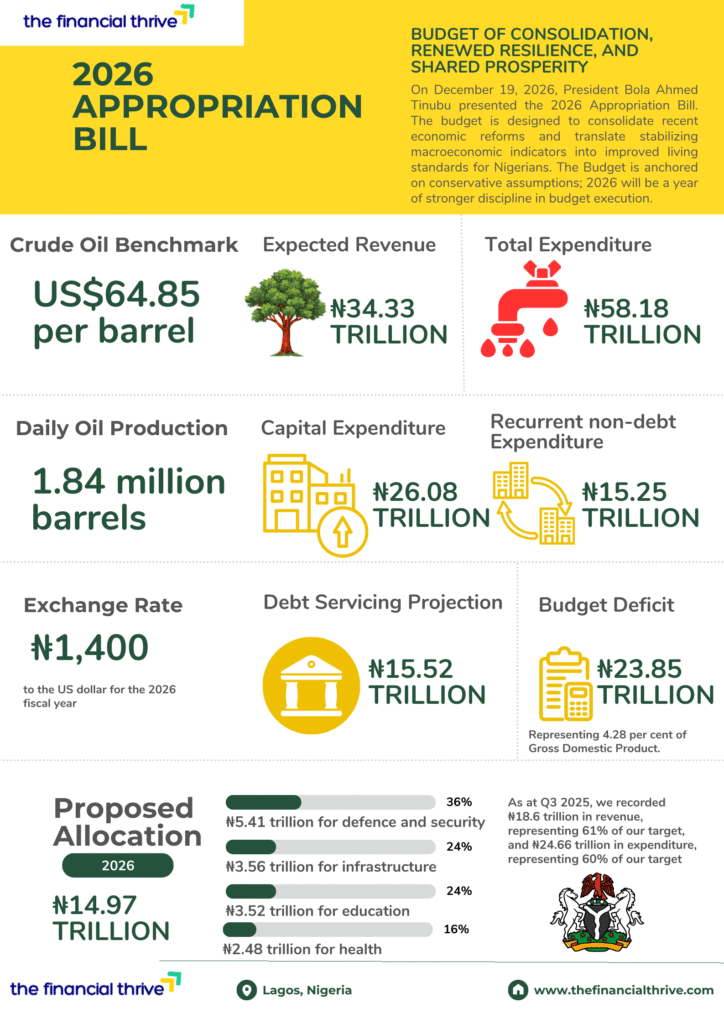

On December 19, 2026, President Bola Ahmed Tinubu presented the 2026 Appropriation Bill to the National Assembly. The theme—“Budget of Consolidation, Renewed Resilience, and Shared Prosperity”—captures the administration’s intent to move Nigeria from a state of reform turbulence to macroeconomic stability and improved welfare outcomes. He said the era of overlapping budgets, abandoned projects, inherited obligations, and perpetual rollovers must come to an end if Nigeria is to achieve fiscal discipline and sustainable development.

Unlike expansionary budgets of the past, the 2026 budget signals a fiscal consolidation phase, focused on discipline, realism, and execution rather than headline spending growth.

Strategic Objective of the 2026 Budget

The 2026 Budget is designed to consolidate recent economic reforms, including subsidy removal, foreign exchange market adjustments, and revenue mobilization initiatives. The goal is to convert stabilizing macroeconomic indicators into tangible improvements in living standards while strengthening fiscal sustainability.

Importantly, the budget is anchored on conservative assumptions, suggesting a deliberate attempt to reduce fiscal slippages and improve credibility in budget implementation.

Key Fiscal Aggregates

The major highlights of the 2026 Appropriation Bill are as follows:

- Total Expenditure: ₦58.18 trillion

- Total Revenue: ₦34.33 trillion

- Capital Expenditure: ₦26.08 trillion

- Recurrent Non-Debt Expenditure: ₦15.25 trillion

- Debt Servicing Projection: ₦15.52 trillion

While capital expenditure remains significant, debt servicing continues to absorb a large portion of fiscal revenue, underscoring the importance of revenue growth and expenditure efficiency.

Macroeconomic Assumptions and Revenue Drivers

The 2026 Budget is premised on the following assumptions:

- Crude Oil Benchmark: US$64.85 per barrel

- Daily Oil Production: 1.84 million barrels

- Exchange Rate: ₦1,400/US$

These assumptions reflect a prudent stance in the face of oil price volatility, production risks, and exchange rate pressures. The success of the budget will depend largely on achieving oil production targets and sustaining ongoing revenue reforms.

Proposed Sectoral Allocations

The government has prioritized security, infrastructure, and human capital development in the proposed allocations:

- Defence and Security: ₦5.41 trillion

- Infrastructure: ₦3.56 trillion

- Education: ₦3.52 trillion

- Health: ₦2.48 trillion

The emphasis on security reflects ongoing national challenges, while sustained investment in education and health signals recognition of human capital as a long-term growth driver.

What the 2026 Budget Signals

The 2026 budget sends three clear policy signals:

- Fiscal Discipline Over Fiscal Expansion

The focus has shifted from aggressive spending to credible consolidation. - Execution Matters More Than Announcements

Budget credibility will be judged by implementation, not projections. - Revenue Performance Is Central

Without strong revenue outcomes, debt sustainability risks will persist.

Conclusion: From Numbers to Outcomes

Nigeria’s 2026 budget is less about ambition and more about credibility. It reflects a government attempting to stabilize the economy, rebuild confidence, and lay the foundation for shared prosperity.

However, the ultimate test lies beyond appropriation figures. Execution efficiency, transparency, and accountability will determine whether consolidation translates into resilience and whether resilience delivers prosperity for Nigerians.

Pingback: Nigeria’s Insecurity Crisis and the Illusion of the “Giant of Africa” - the financial thrive